Discover opportunities for future innovation in UK Professional and Financial Services with the AI For Services Report 2025

In the ever-evolving landscape of the UK’s professional and financial services, innovation is not just a buzzword — it is a necessity. As lawyers, accountants, insurers and finance professionals navigate the complexities of a digital-first world, the drive to stay ahead of emerging trends is intensifying. Opportunities for innovation are abundant, whether it’s through harnessing cutting-edge technologies like AI and blockchain or rethinking traditional business models to meet the growing demand for agility, transparency, and sustainability.

Here, Miles Celic OBE, Chief Executive Officer, TheCityUK shares his thoughts:

“The UK’s status as a world-class international financial centre relies on its ability to innovate, explore, adopt and shape new technologies. Our industry has long been at the forefront of major technological shifts and is a leader in AI adoption and innovation in the UK. Given the range of technologies transforming the industry, from cloud computing and smart data to digital assets, AI and quantum computing, it will be vital that government considers these in the round rather than in silos to maximise opportunities for growth and boost the UK’s competitive advantage.”

For businesses in this space therefore, the challenge lies in leveraging these advancements not only to enhance operational efficiency but to deliver transformative value to clients. Bold and visionary moves are needed now to re-define the future of these sectors, while blending tradition with forward-thinking solutions.

Drawing from extensive research, stakeholder interviews, and industry surveys, the AI for Services 2025 Report offers fresh insights into latest developments, regional initiatives and innovations across the UK’s Professional and Financial Services sectors.

Within this latest edition of the AI for Services report series, readers can identify sector strengths and diversity through an in-depth analysis of regional clusters, that provide a clear picture of capabilities and growth beyond the city of London. Additionally, the report examines the evolving investor landscape, showcasing increasing interest in technology-driven businesses and the growing appetite for co-investment opportunities in FinTech, InsurTech, Accountancy Tech and Legal Tech.

Key findings

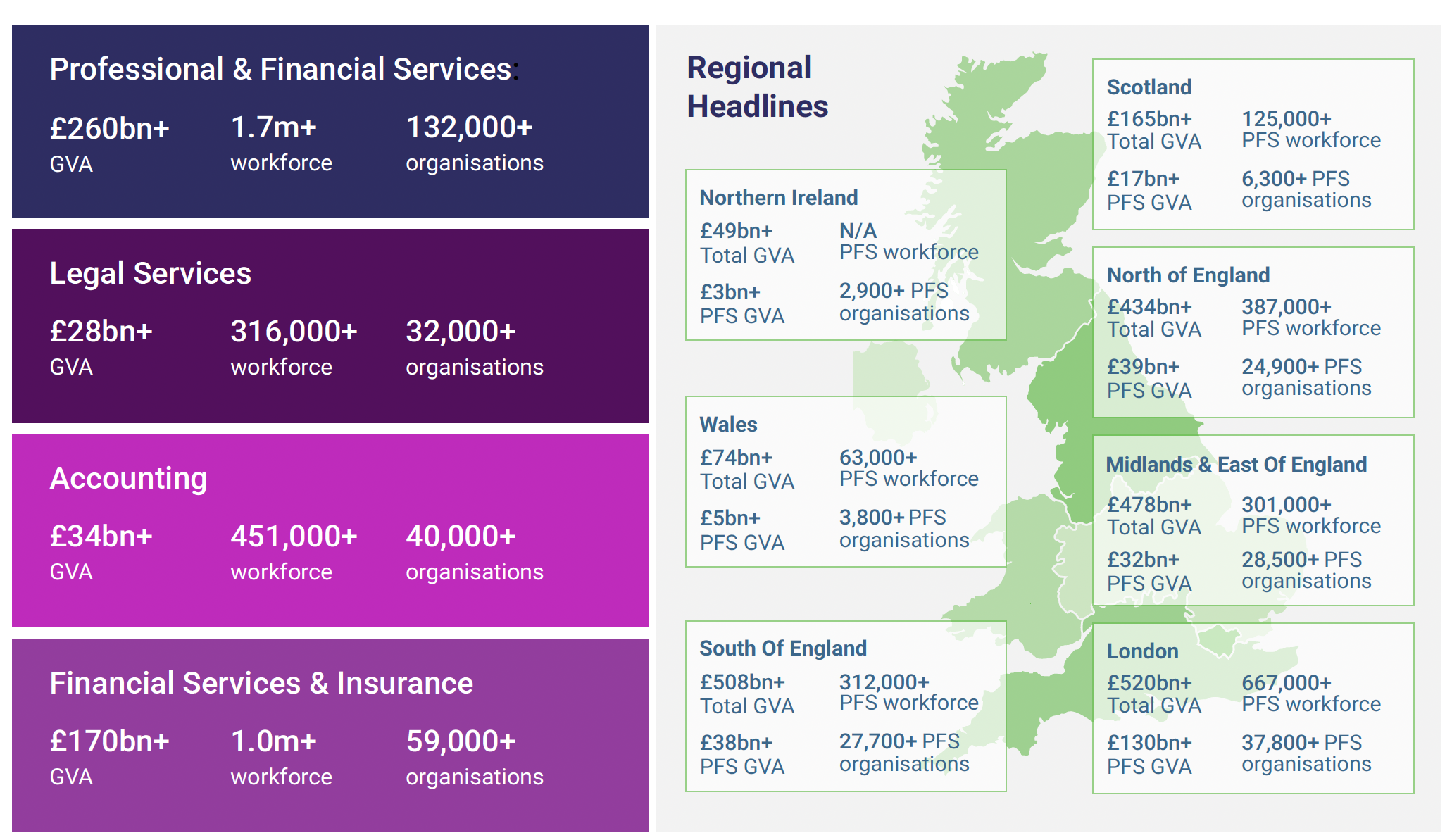

- Sector size and growth potential – The UK’s Professional and Financial Services (PFS) sector contributes more than £260bn in gross value added (GVA) (which is approximately 13% of the UK economy) and employs 1.7 million people across 132,000 organisations. With strong global competitiveness, the sector presents significant opportunities for innovation, investment, and regional expansion across England, Wales and Scotland.

- Digital innovation and technology adoption – The UK’s PFS sector is increasingly driven by digital transformation, with key areas of focus including data management, artificial intelligence, cloud computing, and cybersecurity. Adoption of these technologies is seen as crucial for maintaining global competitiveness.

- Investment and regional growth – Investors are shifting towards businesses with clear paths to profitability, with a growing appetite for co-investment and collaboration. While London holds the largest portion of activity, there is expansion in other regional ecosystems that is driven though challenges such as funding access and supportive policies persist.

- Collaboration and future opportunities – Greater cross-sector and regional collaboration is needed to drive innovation, enhance digital literacy, and improve resilience. Regulatory adaptation, investment in skills, and leveraging emerging technologies will be key to ensuring the sector’s long-term success and societal impact.

Survey response

- Strong confidence in digital adoption – 80% of industry professionals expect a substantial acceleration in digital technology adoption over the course of the next five years, with 82% believing it is crucial for maintaining competitiveness.

- Investment and profitability focus – 77% anticipate increased investment in the sector, but investors are prioritising businesses with clear paths to profitability and efficiency rather than rapid growth.

- Regional challenges and opportunities – 74% of surveyed stakeholders identified funding constraints as a major challenge for regional PFS firms, emphasising the need for increased financial backing outside the capital.

Acknowledgements

This report was commissioned by AI for Services with funding from Innovate UK. We would like to thank all contributors of the report and especially Whitecap Consulting for gathering, analysing the information, and preparing the report.

AI for Services is part of the UKRI Next Generation Professional and Financial Services programme, with a network that includes more than 1,500 leading businesses, researchers, firms and investors who are supporting the transformation of the UK PFS sector in terms of its global leadership position. Our network also demonstrates the opportunity and benefits of undertaking research and development, and shares learnings, discusses common challenges and further encourages innovation transfer.

Find out more about the programme

Visit our homepage and sign up to the AI for Services network to stay up to date with relevant opportunities in Professional and Financial Services innovation.

Related programme

Next Generation Professional and Financial Services

Helping the professional and financial service sectors to develop and use digital technologies.