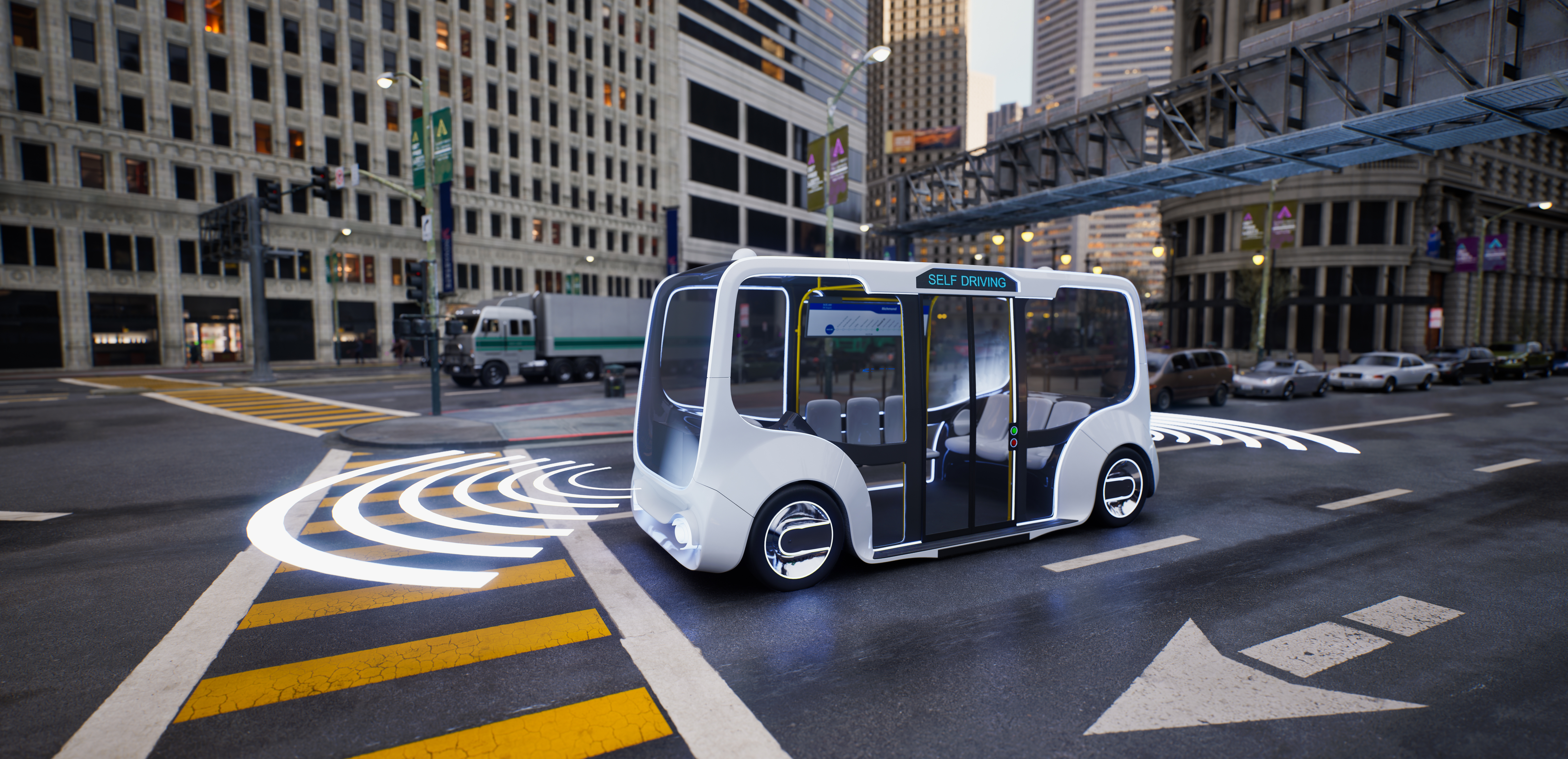

Exploring commercialisation opportunities for Connected Automated Mobility

Economic and operational benefits

The Innovate UK funded Society of Motor Manufacturers and Traders (SMMT) report outlines how Connected Automated Mobility (CAM) could deliver £66 billion per year by 2040 to the UK economy.

Economic Impact

£35bn

Reduced journey times and improvements to non-commercial road users

£16bn

Increases in productivity and cost savings to off-road businesses

£10bn

Wider economic impacts associated with increased road use and increases in taxation

£6bn

Productivity increases and cost savings to on-road businesses

To fully harness this potential, we must look beyond traditional metrics and embrace a broader perspective that values safety, efficiency, and sustainability. By doing so, we can build a compelling and resilient business case for CAM.

The challenge is to develop a robust business case for CAM services that goes beyond basic economic and operational efficiency. This requires a holistic approach that considers the wider benefits in terms of safety, efficiency, and sustainability, involving a much broader set of stakeholder perspectives in the economic modelling for CAM services. By adopting this comprehensive approach, it will ensure that the value highlighted can be clearly articulated in the business plan leading to a more robust and positive business case for the implementation of CAM services. The report also highlights that early adoption of Connected Automated Mobility could generate substantial productivity gains and cost reductions, creating 342,000 additional jobs and saving 3,900 lives by 2040.

Ensuring that the business case is robust from a complex stakeholder perspective is essential, as the value proposition extends beyond basic economic and operational efficiency. The value highlighted in the table above needs to be recognised by a diverse set of stakeholders and the business model of deploying CAM cannot be solely factored into the economic model of operation of a CAM service, versus a conventional (human-driven) service.

There are however “low hanging” opportunities to grab, and the CAM sector can focus on those use cases where the business model complexity is easier to manage.

The low-hanging fruits in commercialising CAM

The integration of autonomous vehicles (AVs) into supply chains can streamline logistics and reduce costs

Autonomous trucks can operate continuously, thereby increasing the utilisation rate of each vehicle. For example, Rio Tinto’s autonomous trucks operate 1000 additional hours per year and have reduced unit costs by 15%.

AVs can optimise routes in real time, reduce fuel consumption, and lower maintenance costs due to less wear and tear compared to human-driven vehicles. In warehouses, AVs can automate repetitive tasks such as loading, unloading, and transporting goods, which increases throughput and reduces labour costs. Companies like Einride have demonstrated the potential for electric autonomous trucks to operate efficiently over short distances by leveraging their freight mobility solutions, which include the Saga software platform. With significant contracts valued at over €3 billion and partnerships with major clients like GE Appliances, Oatly, and Maersk, Einride showcases a scalable model for logistics operations.

Enhanced productivity and cost savings

In the logistics sector, AVs can improve the accuracy and reliability of delivery schedules, enhancing customer satisfaction. Autonomous delivery vehicles can navigate urban environments and deliver packages without delays associated with driver fatigue or human error. This consistency and reliability are crucial for industries like e-commerce, where timely delivery is a competitive advantage.

Truck companies in this sector aim to revolutionise logistics with hub-to-hub autonomous transport solutions, focusing on transporting goods between predefined hubs like warehouses and ports. In Volvo’s case they are running Aurora Driver in their Volvo trucks, these solutions operate 24/7, enhancing efficiency and safety while reducing emissions. Volvo offers this solution on a flexible Transport as a Service (TaaS) Business Model, integrating Volvo’s system with existing management systems, including comprehensive fleet management and control centre support.

Partnerships with companies like Uber Freight and DHL highlight the scalability and reliability of Volvo’s autonomous solutions.

On-road passenger transport

On-road logistics is seen as the most lucrative sector, with a projected UK market size of £15.2 billion per annum by 2040. On-road passenger services, worth £3.7 billion annually, follow as the second largest sector. (SMMT report) This sector encompasses automated buses, minibuses, shuttles, ride-hailing, private hires, and taxis.

The UK has trended towards autonomous logistics and mass transit, over robo-taxis. While robo-taxis has garnered significant attention globally, Their deployment in the UK faces several hurdles, including high operational costs, regulatory challenges, and public acceptance issues.

In China, companies like Baidu’s Apollo Go have implemented aggressive pricing strategies to popularise robo-taxis. Despite these efforts, the service has faced backlash due to traffic disruptions and safety concerns, highlighting the complexity and cost of maintaining such systems. Similarly, in the US, Waymo and Cruise have encountered setbacks with safety incidents and regulatory hurdles, indicating that the profitability and scalability of robo-taxis remain further into the horizon.

Conversely, the logistics sector and mass transit services present a more viable and immediate application for autonomous vehicles in the UK. Autonomous delivery, freight services, and passenger services can operate in controlled or semi-controlled environments, reducing the complexity and risk associated with robo-taxis.

While robo-taxis faces significant barriers to widespread adoption, autonomous logistics offers a more immediate and impactful opportunity for the UK.

What are we doing in the UK?

V-CAL, Logistics

The V-CAL project is one example of the projects funded by Centre for Connected and Autonomous Vehicles (CCAV) through Innovate UK, spearheaded by the North East Automotive Alliance (NEAA) and supported by various partners including Nissan, Newcastle University, and Vantec, that aims to maintain business competitiveness in the North East region by deploying zero-emission battery-powered autonomous HGVs between Vantec sites and Nissan Manufacturing site. This initiative, backed by £8 million in funding, is part of a broader long-term logistics strategy to enhance Nissan’s operational efficiency and address the issue of driver shortages.

Key factors impacting the deployment of automated mobility solutions include the operational environment, technology readiness, regulatory environment, infrastructure requirements, and business impact.

In controlled environments such as Nissan private roads, deployment is facilitated by minimising external variables and complexity, making it ideal for initial rollouts. In contrast, urban mass transit presents more complex challenges due to dynamic environments requiring advanced real-time decision-making technologies, which increase development time and costs.

Regulatory environments also vary, with fewer barriers in private settings allowing for expedited deployment, while stringent regulations and public acceptance pose significant hurdles in urban areas. Infrastructure requirements are minimal for private roads but extensive for urban settings, necessitating substantial investment.

CAVForth 2, Mass Transit

The CAVForth project is a great example of advancing autonomous vehicle deployment in public spaces. In its most recent funding award, CAVForth2, the aim is to operate more complex autonomous passenger services in Edinburgh, focusing on integrating CAM technology with public transportation. By engaging multiple stakeholders, including government regulators, technology providers, and the local community, the CAVForth project exemplifies the collaborative approach that will be necessary for successful and more complex CAM implementations.

Strategic prioritisation

By focusing on early opportunities, projects like V-CAL and CAVForth build market confidence and demonstrate the benefits of autonomous mobility. Prioritising deployments in simpler settings allows for gradual scaling and refinement of technologies and commercial readiness, ultimately facilitating a smoother transition to more challenging applications and broader commercial models. This phased approach ensures continuous improvement, builds public and market confidence, and maximises the economic and societal benefits of autonomous mobility technologies.

The Innovate UK-funded SMMT report underscores the potential of CAM to contribute £66 billion annually to the UK economy by 2040, highlighting both the direct and broader societal benefits. However, it is crucial to recognise traditional cost models based solely on operational efficiency often do not consider the broader societal benefits. Instead, a nuanced approach that factors in improved road safety, productivity gains across sectors, and the economic contributions of new technology firms is essential. This requires innovative business model thinking to fully appreciate and develop the value proposition of CAM.

Early opportunities lie in logistics and mass transit sectors within defined operating environments, where the integration of autonomous vehicles can streamline operations, reduce costs, and enhance service reliability. Early initiatives such as the V-CAL and CAVForth projects a starting to demonstrate the feasibility and benefits of CAM in the UK, paving the way for broader applications.